The World According to Gary

Gary Economics (né Stevenson) is formerly “the best f***ing trader in the world” and now a “great f***ing economist”, at least according to him. Gary started off as a trader at Citigroups STIRT (Short Term Interest Rate Trading) desk, where he worked from 2011 to 2014. His success as a trader earned himself a mouth-watering bonus: £2 million! Feeling that making millions from trading was immoral, he went back to get a master’s in Economics and started making millions from selling books about trading instead. Gary also owns a YouTube channel with 1 million subscribers.

In his videos, he presents his grand theory of wealth inequality, asset prices, and growth. He explains how the low interest rates of the 2010’s and growing house prices were caused by ever-increasing wealth inequality. The other distinguishing feature of his videos is the complete lack of any sources, citations, evidence, or clear explanation of his model. This makes his claims very difficult to assess, because it is rarely obvious what exactly he means or is talking about. However, in a shocking turn of events, I have recently discovered that Gary has published his master’s thesis on his website. Most of Gary’s claims seem to come directly from his model in this thesis, so we can look at the model directly, instead of trying to reverse engineer it from the ramblings in his video. The problem for Gary is that his thesis is…

-Cue dramatic music, fade to black, roll title card

Bad Economics

To the surprise of no one familiar with Gary, his thesis argues that wealth inequality drives up asset prices and, as a result, locks poorer people out of acquiring assets. His model shows how high levels of inequality push asset prices higher. Additionally, he shows that this holds when poor people desire assets as much as the rich do or when multiple asset types exist. He concludes by demonstrating that high asset prices have negative welfare effects. How does Gary reach these conclusions? And do they hold water? In short: no, and absolutely not. The thesis is a chaotic tangle of bad assumptions, contradictions, and half-baked logic. What follows is a closer look at exactly how Gary’s tangled mess unravels and why it was doomed from the start.

The Model

Gary’s model is simple enough: Start with a production function, a utility function, and a budget constraint.1 Everything else you can build up from that. Next, you solve for the price of wealth, expressing it in only exogenous variables. Finally you interpret the results.

Asset accumulation equation

Gary starts by explaining:

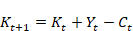

Since my interest is in the relative price of assets and consumption, I will not be able to use traditional capital accumulations of the form:

Because:

Equations of this form imply that the consumption good and the capital good can be freely transformed into one another. When a model allows for this free, bidirectional transformation, there can be no space for interesting movements in the relative prices of the two goods. Equations of this sort are not suitable for models interested in changes in this relative price… In order that it is always clear exactly which kind of asset is being discussed, I will henceforth use K (capital) for reproducible assets, T (as in terra or land ) for non reproducible assets in models where both reproducible and non reproducible assets exist, and W in simple models with only one, non reproducible asset, to represent all forms of wealth.

Does this form imply the consumption good can be transformed into the capital good? No. Here’s my best guess as to why Gary believes this: Gary believes Y consumption good is produced, and at the end of the period t, we decide how much we want to transform into capital. It makes much more sense to assume that we decide how much capital we want first, and then produce a combination of capital and consumption goods, which adds up to total value Y.

The Utility function

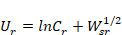

In Gary’s model, the poor consume all of their income. The rich get utility from wealth and consumption:

Where Wᵣ is consumption and Wₛᵣ is post consumption wealth. I think both of these assumptions are fine.

Interest Rates

Interest rates are often considered to be percentages, yet this is not technically correct if we have a mismatch of units- if one house yields a return of 7,000 in one year, it is not correct to say that the house has an annual yield of 7,000%.

Thanks for clearing up any confusion Gary. It is funny that while talking about mismatched units (subtle foreshadowing), Gary doesn’t specify what unit the return is in.

It is a return, in consumption goods, on a unit of the asset. Throughout this paper, I will use the term r to refer to this quantity, but it will never be a percentage- it will be the price, in consumption goods, paid to rent one unit of the asset.

The Inequality Mechanism

To describe inequality, Gary uses E, equality, which takes values from 0 to 1. It represents how much of a society is rich, where higher means a higher percentage of rich, so less inequality. To maintain clarity, the total number of people is always 1. The number of poor people will therefore always be 1-E.2

The Static Model

Timing is as follows: The rich receive their inherited wealth, their labour income and their wealth income. Labour income and wealth income are both determined by the normal supply side equilibrium conditions, which I will explain later, and are paid in units of the consumption good. They then enter into the market for wealth and the consumption good. Relative price adjusts in a Walrasian fashion to clear both markets. I will normalise the price of the consumption good and use p for the price of the wealth good. The price p will thus be in units of the consumption good.

I then specify both the production function, and the Utility function of the rich, both of which will be generalized later. The specific functions I chose were as follows:

and

Where Ur, Y , A and a are utility of the individual rich, output (in terms of the consumption good), a technology parameter and the labour share of income, respectively, completely as a standard Cobb-Douglas production function. A is positive and a is in [0,1].3

Market clearing in the consumption good, recalling that a mass of (1-E) poor people consume all their labour income:

Market clearing in wealth is simply:

Wₛᵣ refers to the saved wealth of the individual rich, W̅ is total wealth. w and r are returns on units of labour and wealth respectively. p is the cost of one unit of wealth. The cost of the consumption good is 1. Wᵢ is inherited wealth. What’s the difference between Wᵢ and Wₛᵣ ? Nothing. In fact, on page 23, Gary defines them both as W̅/E.

So, let’s look at the budget constraint.

If you’ve been paying attention so far, you should notice that this looks suspiciously similar to the capital accumulation function he said he wouldn’t be using. What’s even funnier is that this actually does imply you can convert the consumption good into wealth; If Cᵣ=Lw, then we are left with Wₛᵣ= (1+r/p)Wᵢ. Since r is paid out as a consumption good, it means we have turned a consumption good into wealth. Gary specified, however, that total wealth is fixed. We can’t convert the consumption good into wealth or wealth into consumption. Those two assumptions are not only the defining and most important parts of Gary’s model; They are also the reason the model doesn’t work: Wealth is fixed, meaning Wₛᵣ=Wᵢ. We can cut W from both sides of the budget constraint, which leaves us with:

This makes perfect sense. Since the rich can’t buy any more land, they will consume all the income from their labour and wealth. As a bonus, p cancels out. This is the actual budget constraint. Gary does come up with this a few pages in (4.9), he just doesn’t realize what the implications of it are. All the problems in the thesis come directly from the mistake he makes here.

The logical next step when you have your model defined, is to start solving it. But -shock horror- there is nothing to solve. There is no decision to make for the rich, other than a trivial one: How much of their consumption good do they want to throw down a hole, and how much they want to consume. Gary tries to solve the spending-saving problem of the rich, but there is nothing there to solve. He uses the budget constraint that only works when wealth is not fixed together with the market clearing for wealth condition, which only works when wealth is fixed. The result is: Nonsense

There is not much more to comment on in chapters 4 and 5, since everything is a result of the faulty budget constraint. 4

The Dynamic Model

Ok, so maybe the basic form of the model is nonsense, but what model isn’t at least slightly wrong? After all, we want models to be useful, not to be completely accurate. If the problem is that wealth is fixed, then the dynamic model, where we have different types of wealth, should ameliorate that, right?

I will implement two forms of productive asset in the model; accumulable capital, which I shall call K throughout, and fixed land, which I shall call T, for “terra”, throughout.

Since reproducible capital, K, and the consumption good, C are in some sense equivalent, as in most economic models, there will be no concept of a “price” of reproducible capital. I will employ a capital accumulation equation such that, in any time period t, Cₜ and Kₜ can be costlessly converted into one another, and thus the relative price of the consumption good and the capital good will always be 1.

Note that, now that there are two assets, this decision is more complicated - the agent must choose not only how much to save, but how to allocate that savings between the capital asset and the land asset.

This problem will be solved by introducing the variable Bₜ, which is defined as the amount of capital which is bought in period t in exchange for land. Thus Bₜ is in units of the capital good.

Isn’t T supposed to be constant? Let’s ask Gary:

After this, agents simultaneously choose both how much of their consumption good/capital (remember the two are the same) to consume and how much to save, and how much capital to sell/buy in exchange for land, which is the quantity known as Bₜ . Since total stock of land is fixed, the price pt will adjust so that aggregate Bₜ is zero; since the poor consume all income, and thus do not participate in land or capital markets, Bₜ must be zero for the individual rich for the market to clear.

Oh…So why even introduce Bₜ?

This is technically incorrect: Bₜ isn’t 0 because the markets must clear, it’s 0 because it’s always 0 by definition. The rich all have the same utility function and wealth is evenly distributed between the rich, which results in no trade between the rich.5 If your model only works once you add a variable that is fixed at 0, there is something deeply wrong with your model. Once more, the rest of the chapter is a consequence of nonsensical foundations.6

The OLG model extension

Until now, high asset prices haven’t actually hurt the poor, since they don’t gain utility from wealth. To deal with this Gary expands his model to an overlapping generations framework7, where poor people want to accumulate wealth to save for when they are old. Gary, so far, is batting 0-2, but this is his chance at redemption. The OLG model is suited for what Gary is trying to show. In his model, the rich are infinitely lived and get utility from holding wealth directly. The poor seek to maximise their consumption over two periods, using wealth only as a store of value. The poor work and save while young, while the rich seemingly work when young and old. He doesn’t mention if or when the rich work, but the math implies they work when young and old.8

This is the first time in the thesis that the poor don’t consume all their income, or have the same utility function as the rich, meaning we might actually have interesting results.

However, within this context non-reproducible assets traded at a premium to reproducible capital due to their explicit utility effects for the rich. In such a model, poor people, if they were prioritising only consumption, would always have an incentive to use only reproducible capital for saving. As such, to explore the question of whether unaffordable assets can affect the lifetime consumption of the poor through hindering their ability to access assets, we must return to the model where all assets are affected uniformly by asset price changes, that being the single asset model. As such I will be returning to the single asset model, where W represents all assets and is fixed, for the entirety of this extension.

Let’s see how he tackles this:

I return to the use of W for capital/land/wealth to signify that I am again in a fixed asset world. The budget constraint of the rich is:

How disappointing. This is just the same mistake from the static model.9 The budget constraint for the rich should be:

Gary, like in the previous chapter, comes up with this constraint himself eventually:

At steady state, W is constant across time, implying that:

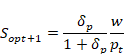

I will skip explaining the next few expressions since they are extremely similar to those in previous chapter. The first new part is the savings of the old poor at time t+110. 𝛿 is a constant, exogenous discount factor11:

(11)

We also know that the total wealth holdings of the rich, plus total wealth holdings of the old poor must equal the total wealth existing in the economy. Calling the total existing wealth W̅ we then have:

(14)

This is very strange. If total wealth is fixed, what happens when the poor increase their savings? Do the rich lose wealth? Is it redistributed? This expression implies W̅ that either is not fixed, or that savings decrease wealth.

Substituting in equation (11) for and rearranging we can thus reach the following expression for

(15)

Gary never steps back and gives interpretation of the math. He really should have, because it is vital if the poor saving directly reduces the wealth of the rich. If total wealth is not fixed, Wᵣ is constant12. If total wealth is not fixed, Wᵣ cannot be constant. The conclusion is that Wᵣ and W̅ can’t be constant simultaneously. One being constant implies that the other one cannot be. I’ve alluded to this earlier, but Gary seems not to know the difference between “being constant in steady state” and “being fixed and exogenous”.

…recall that W̅ and L are fixed and exogenous

This is not possible. If W̅ is fixed, you must be able to explain how the wealth of the rich goes down. Especially since p represents the price of wealth, and W̅ is simply total wealth units (like area of land), not the value of wealth, which is pW̅.13 Savings don’t reduce the value of land; they decrease the total amount of land. I do not believe this is an assumption Gary made, so the only other option is that W̅ is not actually fixed. If it is not fixed, “there can be no space for interesting movements in the relative prices of the two goods”, as Gary has already pointed out.

Conclusions

Gary provides a masterclass in how not to build a model. Every aspect of this thesis follows the same formula: When introducing the model, wealth is fixed. When he starts solving it, wealth stops being fixed, and when it comes time to interpret the results, wealth goes back to being fixed. Economists use mathematical models to prevent you from making flawed but convincing arguments. Gary shows that it is possible to hide unconvincing arguments behind the veil of rigorous mathematics. There are so many more problems in this thesis that I simply don’t have the time and space to address here.14 I do want to end on a positive note: I appreciate that Gary, who does cite his credentials occasionally, actually published his master’s thesis. It is a shame that it is not a societal expectation to show your master’s/PhD thesis if you mention your degree as a public figure.15

For those unfamiliar with economics, this is called Constrained Optimization, where you combine the utility function, which tells you how much utility you gain from a certain combination of goods, and the budget constraint, which tells you what combinations of goods you can afford.

Because E is always between 0 and 1, it leads to “total wealth” actually being smaller than “individual wealth”. This is not an issue and does not change the math.

a is the capital share of income, this is a typo, Gary will correctly refer to it as such for the rest of the thesis.

The only other noteworthy thing is figure 4.2 on page 26, where Gary manages to both mislabel the y-axis ( instead of ) and have the x-axis show E going up to 1.6.

Since all agents are identical, any trade that would improve the utility of one rich person will also decrease the utility of another.

Even so, Gary pushes his model to the brink of making some sense on page 26:

For those familiar with the history of capital and land models, it will also be reminiscent of the classic result r=ρ/p from the work of Feldstein (1977) and others.

It isn’t just “reminiscent”, it‘s the same equation. hₜ(C,T) is just 0 because T is fixed.

In an overlapping generations model, people live for 2 periods. Typically, young people are given an endowment (think of this as young people being able to work), and save to consume when they are old. The model can then be modified to whatever purpose you need it for.

Whether the rich work while young and old isn’t terribly important, but it does showcase sloppiness on Gary’s part.

The first time I read this, I thought Gary had purposefully removed L . But no, L shows up again later, he just completely forgot it here.

opt stands for old poor at time t

The discount factor describes agents preferences between consumption now and consumption later. A discount factor of 0 means agents save nothing and don’t value future consumption. A discount factor of 1 means agents are indifferent between future and current consumption.

If you look at (15): W̅ increasing means any change in the minuend and the subtrahend of the right hand side cancel out.

Yes, this sounds bizarre, and is another huge fundamental issue with the model. I have not tackled this because correctly setting up the budget constraints makes p cancel out anyway, rendering this irrelevant.

But at least Gary gives us some funny quotes in the discussion chapter:

I believe that more discussion of this particular assumption is needed. I do not believe it is true that capital is fixed. But I also do not believe it is true that capital can be formed effortlessly from consumption goods. Indeed, the past decade of global real interest rates planted firmly at, or below, zero, shows us that, in the real economy, situations can often exist where it is very difficult for savers to form new capital at all.

Interest rates, also, which are constantly being predicted to raise back to “normal” historical levels, would be implied to actually be permanently low, due to new higher levels of wealth inequality, unless, for some reason, wealth inequality could be predicted to fall back down.

So does Gary think it has become easier to save post-covid, when interest rates are higher? No, because when interest rates are high, Gary talks about how high inflation is eating away at peoples incomes.

I realise I’m not exactly helping here since I’m using Gary’s master’s thesis against him.

This is such a relief to hear, his masters thesis model has errors so rapidly accelerating wealth inequality isn’t a problem and the average worker will be able to afford a house any day now

Interesting read, but this feels like a performative refutation rather than a substantive one.

The critique focuses more on vibes (“bad economics,” “copy trading,” fuzzy equations) than actually engaging with Gary’s core thesis—namely, that UST supply/demand dynamics, liquidity flows, and Fed/RRP mechanics are now more explanatory than the traditional macro models this post gestures at.

Dismissing liquidity-based analysis because it doesn’t wear the uniform of DSGE models or invoke “state variables” misses the point: those models haven’t worked for years in predicting bond markets.

Calling it “bad economics” while defending frameworks that missed 2020–2023 macro entirely is bold.